What can the Netherlands mean in this?

Battery recycling: the story so far

Recycling electric-vehicle (EV) batteries represents an opportunity for Europe to significantly reduce its dependence on Asian battery and raw-materials suppliers. To this end, significant steps are already being taken in several European countries. With this in mind, what role can industry in the Netherlands play in the processing of batteries?

In 2012, some 130,000 electric cars were sold worldwide. Less than 10 years later, that many were being sold per week. According to the International Energy Agency, 6.6 million people bought electric cars (fully or partially electric) in 2021, equivalent to a market share of nine per cent. While predictions for the further growth of electric driving vary, major car brands such as Volkswagen and Ford have ambitious growth plans: by 2030, half of all new cars will need to be of the plug-in variety. And the ambitions of some European countries go even further!

European frontrunners

The increasing pressure on raw materials – including the geopolitical friction it can lead to – is making the recycling of EV batteries more and more important. Of course, in the bigger picture this also includes the ambition of “closing the loop”, realising a climate-neutral Europe by 2050. Norway – the European leader when it comes to EV driving – is currently taking huge strides in battery recycling. Hydrovolt, a joint venture between Swedish battery manufacturer Northvolt and Norwegian energy and aluminium producer Norsk Hydro, can recycle 8,000 tons of battery modules per year. They will focus on discharge and reduction. The resulting black mass will be processed at other facilities, such as at Northvolt in Sweden.

Battery processors are also hard at work in Germany. Manufacturers themselves are setting up pilot plants. Furthermore, parties such as Duesenfeld are applying the so-called Duesenfeld method to achieve a material-recovery percentage with lithium-ion batteries that is almost double that of conventional recycling methods.

Battery Recycling in the Netherlands

The Netherlands’ first recycling factory

These manufacturers are readying themselves to comply with the European Union’s ambition of keeping raw materials inside Europe and ensuring that the production of new batteries is partly realised with the use of materials from old batteries

Janet Kes

Manager batterijen ARN

Hydrometallurgy: working with black mass

The first step in hydrometallurgy is mechanical separation. After the battery has been shredded, black mass is created on the one hand and metal material flows on the other. The black mass is from the cathode and anode materials. It is converted into a liquid solution in several steps, enabling the recovery of cobalt sulphate, metal salts and graphite. This is the so-called “chemical leaching process”. The materials thus extracted, which include lithium, manganese, nickel and cobalt, are used to build new batteries, taking us a step closer to that closed loop. Hydrovolt claims to have already reached a material-recycling efficiency of at least 80 per cent and expects to be able to push this percentage even higher.

Higher material-recycling percentages

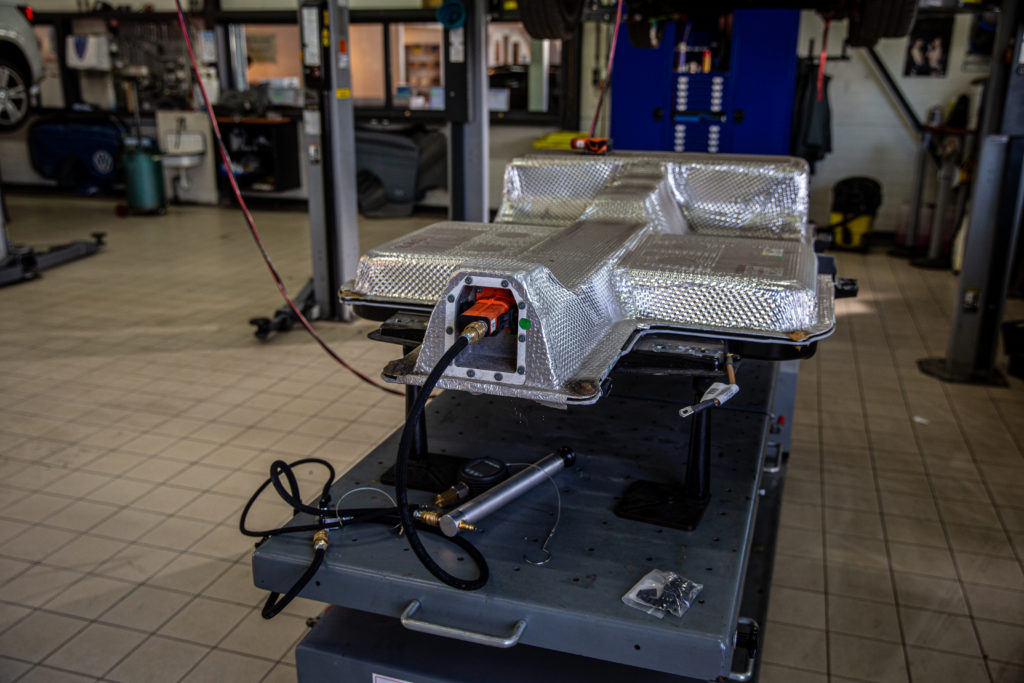

The role of the car manufacturer

Given its position, ARN closely monitors any developments pertaining to batteries. Driven by the strategic importance of being able to keep producing electric vehicles in future, car manufacturers are also paying a lot of attention to battery recycling. “These manufacturers are readying themselves to comply with the European Union’s ambition of keeping raw materials inside Europe and ensuring that the production of new batteries is partly realised with the use of materials from old batteries,” says Janet Kes, Manager Batteries at ARN. “Among other reasons, the thinking behind this is to still have access to those scarce raw materials further down the line.”

Legislation and regulations

A lot is expected to happen in the area of legislation and regulations during the next few years. For example, much is expected of the Battery Regulation, which is likely to come into force in 2023. Furthermore, well-defined plans pertaining to the mandatory use of recycled materials in batteries are already in place.

Accumulating knowledge about battery recycling in the Netherlands

The Eindhoven Brainport – home to a variety of high-tech companies – is also known as the Netherlands’ Silicon Valley. In Brainport itself, the economic development company Brainport Development plays a key role, with one of its ambitions being to invest in a national battery ecosystem. The objective is to organise the chain and stimulate the exchange of knowledge between companies, knowledge institutions and other stakeholders. This will accelerate the application of batteries and scale-up the development of a new generation of battery technologies. Knowledge about innovative battery recycling could also fall within the auspices of a national battery ecosystem. To combine strengths and help accumulate the necessary knowledge, ARN is participating in a number of collaborative initiatives, such as the Battery Competence Center.

The battery is developing

While battery recycling quickly develops, the battery itself is also changing. The cobalt-free battery is becoming increasingly popular. This type of battery is under development by Tesla, Panasonic and the Chinese SVOLT, the latter being a subsidiary of car manufacturer Great Wall Motors, of which BMW is a local partner. Furthermore, car manufacturers, universities and development centres are also working on completely new battery technologies. These range from solid-state to magnesium-ion and from dual-carbon to lithium-air, or even the supercapacitor. Should one of these new battery types get the upper hand, it could have major repercussions on how we should be recycling batteries.

Sustainable Development Goals

For the fourth year, ARN is benchmarking itself against the Sustainable Development Goals (SDGs) with the motto ‘lean and green’ in mind. The coloured SDGs shown on the right apply specifically to the content of this page.